Your revenue cycle is supposed to be the heartbeat of your practice — yet for many providers, it feels more like a slow leak. You submit claims, wait weeks for payment, and still end up writing off thousands in unpaid balances.

The Pain Points We Hear Every Day:

- “Our A/R is getting out of control.”

- “We’re resubmitting the same denials again and again.”

- “Collections are down, but our billing costs keep going up.”

These aren’t just billing issues — they’re system issues. Poor eligibility checks, missing documentation, coding errors, and lack of denial follow-up create a domino effect that drains revenue and staff morale.

Why Generic RCM Services Fall Short

Many practices outsource RCM to cut costs, only to discover that “low-cost” billing actually means:

- Limited follow-up on denials

- Minimal reporting or insight into revenue trends

- No proactive approach to fixing systemic issues

MedVoice’s RCM Approach

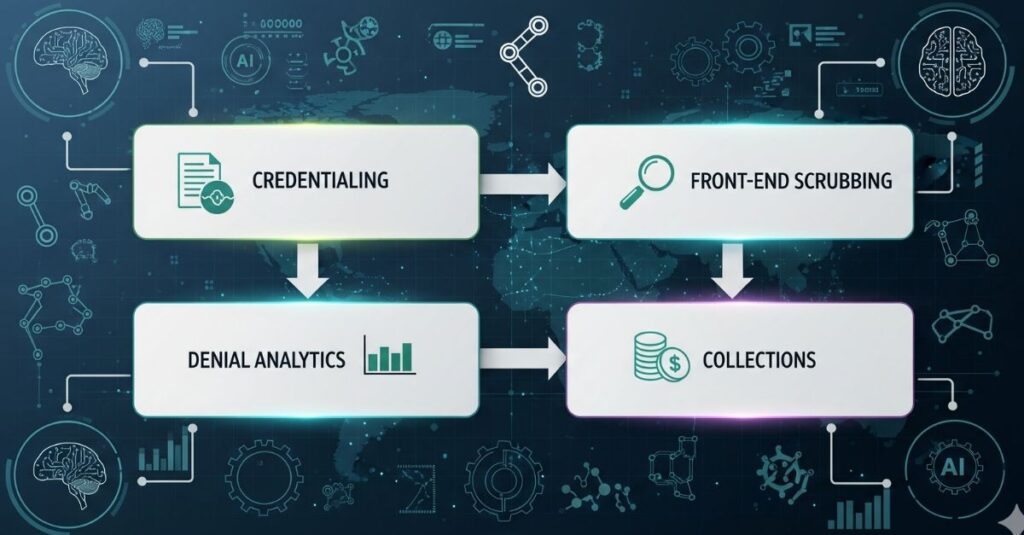

At MedVoice, we look at the entire revenue cycle, not just the billing step:

- Credentialing Checks: We verify provider enrollment before claims ever go out

- Front-End Scrubbing: AI-powered tools flag coding/documentation errors instantly

- Denial Analytics: We don’t just fix denials — we prevent them from happening again

Practices that work with MedVoice see a 15–20% boost in collections within 90 days, simply because revenue stops slipping through the cracks.

Takeaway: If your cash flow feels unpredictable, the problem might not be your payers — it might be your process.