Why Billing Errors Are No Longer Operational Issues — they’re Strategic Financial Risks

Revenue does not disappear overnight. It leaks slowly. One incorrect patient detail. One coding mismatch. One delayed claim. These small issues turn into serious financial risks. For healthcare leaders, Medical billing and coding services are no longer just back-office functions. They are core financial drivers.

Today, CFOs must see billing accuracy as a financial strategy. When errors enter the system, cash flow slows, denials rise, and A/R increases. Clean claims, fast submissions, and strong documentation protect revenue. Strong medical billing services create clarity, control, and proven growth. Precision in billing is not optional. It is protection.

The Hidden Cost of Inaccurate Patient Information on Revenue Integrity

Patient data is the first step in the revenue cycle. If it is wrong, everything that follows is at risk.

Simple errors such as:

- Misspelled names

- Incorrect insurance IDs

- Wrong date of birth

- Outdated policy information

These issues lead to claim rejections before review even begins.

For a CFO, this means:

- Delayed payments

- Higher administrative costs

- Increased staff workload

- Lower collection rates

Each rejected claim requires rework. Rework consumes time. Time consumes money. Accurate front-end processes create financial clarity. Precision at the start protects revenue at scale.

Revenue integrity begins with data accuracy. When patient details are verified properly, clean claim rates improve, and financial stability strengthens.

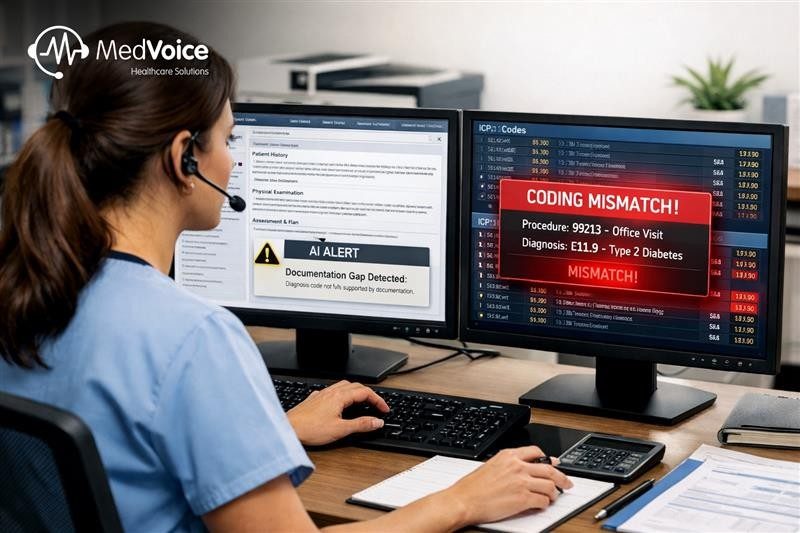

Coding Mismatches: How Documentation Gaps Turn Into Financial Leakage

Coding connects clinical care to revenue. When coding does not match documentation, payment risk increases.

Common coding issues include:

- Missing modifiers

- Incorrect CPT or ICD codes

- Under-coding that reduces revenue

- Over-coding that triggers audits

Documentation gaps often create coding confusion. Even skilled teams face challenges when clinical notes lack clarity.

Financial impact includes:

- Denials and payment reductions

- Compliance exposure

- Audit risks

- Lost reimbursement opportunities

Accurate medical billing services use structured processes, trained experts, and technology-driven intelligence. Coding must align with documentation at every level.

When coding precision improves, revenue protection improves. Financial leaders gain better insights into performance, payer trends, and reimbursement patterns. Coding is not clerical work. It is financial control.

Delayed Claim Submissions and Their Direct Impact on Cash Flow & A/R

Time is money in healthcare finance.

Delayed claims create slow cash flow. Slow cash flow increases Days in A/R. High A/R reduces working capital. When submission timelines stretch, financial pressure builds.

Reasons for delays often include:

- Manual workflows

- Missing documentation

- Inefficient review systems

- Lack of real-time tracking

Every day a claim sits unsubmitted is a day revenue remains locked.

Strong Revenue Cycle Management Services focus on speed with accuracy. Fast claim submission improves:

- Cash flow predictability

- Reduced A/R

- Stronger financial reporting

- Better decision-making

CFOs require visibility and clarity. Timely claims create financial stability. Precision combined with intelligent systems supports sustainable growth.

Claim Denials, Rejections, and Rework: The Compounding Cost to Healthcare Finance

Denials are not single events. They are compounding financial risks.

Each denied claim brings:

- Staff rework time

- Delayed revenue

- Increased operational cost

- Reduced team productivity

Denial trends often reveal deeper process gaps. Without analytics and insights, these issues repeat.

High denial rates reduce clean claim percentages. Lower clean claims increase stress on finance teams. This cycle slows performance and impacts profitability.

When healthcare organizations invest in advanced processes, denial patterns become clear. Root causes are addressed early. Clean claims rise. Rework decreases. Financial clarity improves.

Precision-driven billing systems supported by intelligent technology reduce risk. They create measurable improvement in revenue cycle performance.

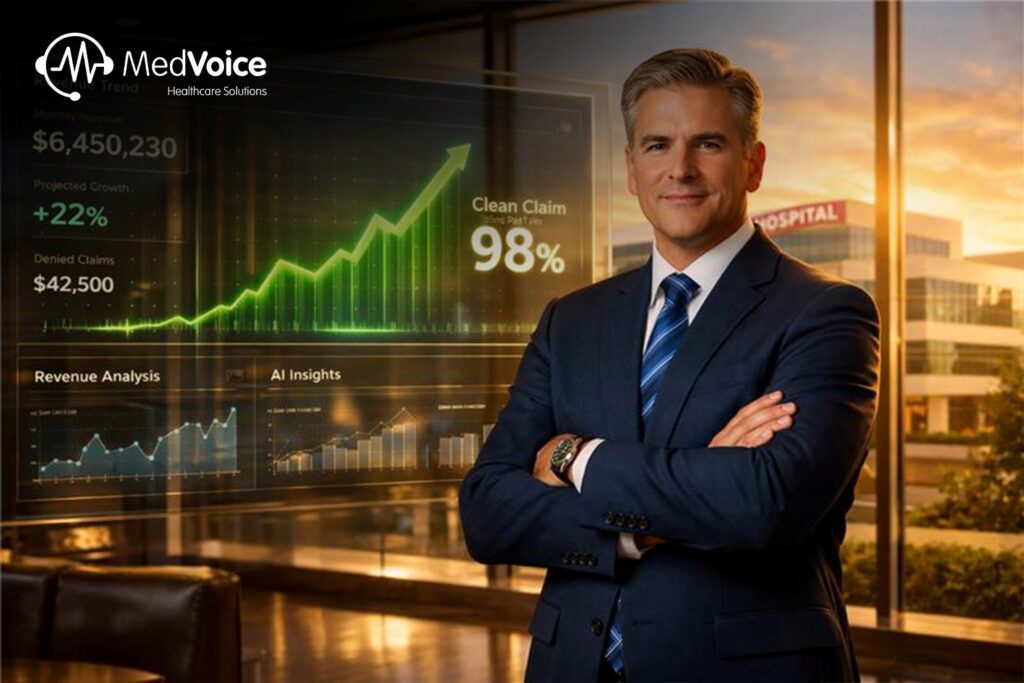

Best Practices for CFOs: Building a Billing Accuracy Framework That Protects Revenue

CFOs must lead billing transformation with structure and intelligence.

Key strategies include:

- Implement strict patient data verification at intake

- Ensure coder education and compliance training

- Use technology for real-time claim tracking

- Monitor denial analytics monthly

- Set clean claim rate benchmarks above 95%

- Reduce manual workflows through automation

A billing accuracy framework requires collaboration between finance, operations, and compliance teams.

A trusted growth partner with multi-industry expertise can bring global client engagement insights into healthcare finance. With advanced AI-powered systems, clean claim rates can reach up to 98%, while A/R can reduce by 40%.

This level of precision delivers clarity. Clarity delivers control. Control drives proven growth.

From Revenue Loss to Revenue Protection: Making Billing Accuracy a Core Financial Strategy

Financial leaders can no longer treat billing as a back-office task. It is a strategic financial engine. When errors reduce, revenue stabilizes. When processes improve, cash flow strengthens. When intelligence guides decisions, growth becomes predictable.

MedVoice delivers AI-powered precision through advanced medical billing and coding services designed for scale, clarity, and intelligence. With HIPAA-compliant systems, 98% clean claims, and measurable A/R reduction, the company stands as a trusted growth partner. Through globa client engagement and proven expertise, MedVoice transforms billing accuracy into financial strategy.

Frequently Asked Questions

Why are medical billing errors considered financial risks?

Billing errors delay payments, increase denials, and raise operational costs. These issues directly affect cash flow and revenue stability.

How do medical billing and coding services improve revenue protection?

They ensure accurate patient data, correct coding, timely submissions, and denial management. This improves clean claim rates and reduces A/R.

What is the impact of delayed claim submission?

Delayed claims slow cash flow, increase A/R days, and create financial uncertainty for healthcare organizations.

How can CFOs reduce claim denials?

By monitoring denial analytics, improving documentation, using intelligent tracking systems, and maintaining strong compliance processes.

Why should billing accuracy be part of financial strategy?

Accurate billing protects revenue, improves forecasting, strengthens compliance, and supports sustainable long-term growth.